Your credit report is more than just a number—it’s a detailed record of your financial life. When lenders or credit card companies evaluate your creditworthiness, they use your credit report to make important decisions about your financial future. Whether you’re looking to get approved for a loan, a debt consolidation, or to refinance your mortgage, understanding your credit report is essential.

In this article, we’ll break down the key sections of your credit report to help you understand what’s on it, why it matters, and how you can use this information to improve your credit health. If you’ve ever felt confused by the term “credit report” or wondered what goes into it, don’t worry. We’ve got you covered.

What Is a Credit Report?

A credit report is a detailed summary of your credit history, and it includes important information that lenders, landlords, and even some employers may use to assess your financial behavior. This document contains personal details, account information, and a record of how you’ve handled past and present debts. Your credit report plays a huge role in determining whether you can qualify for loans or credit cards, and it can also impact the interest rates you’re offered.

If you’re thinking about debt consolidation to manage multiple debts more easily, your credit report will give lenders a clear picture of your financial situation, including your outstanding debts and payment history. This helps them determine whether consolidating your debts is a good option for you and if you qualify for favorable terms.

The Key Sections of Your Credit Report

Your credit report may vary slightly depending on the credit bureau (Experian, TransUnion, or Equifax), but all credit reports generally contain the same basic sections. Let’s take a look at the main categories of information found in a typical credit report.

- Personal Information

At the top of your credit report, you’ll find your personal details, which include:

- Your full name

- Your current and previous addresses

- Your Social Security Number (or partial number)

- Your date of birth

- Your current and previous employers

This section is essentially used to verify your identity. The information here ensures that lenders and other entities are looking at the correct report, especially if there are others with similar names or credit histories.

- Credit Accounts (Trade Lines)

The credit accounts section of your credit report includes a detailed list of all your open and closed accounts. This section provides information about:

- The type of credit account (e.g., credit cards, auto loans, mortgages)

- The name of the lender or issuer

- The date the account was opened

- The credit limit or loan amount

- Your current balance

- Your payment history (including any missed payments)

This section helps lenders determine how much credit you’ve been given and how well you’ve managed it. If you’ve been consistently making payments on time, it will show as positive information. On the other hand, missed payments or high credit utilization can hurt your credit score.

- Payment History

Your payment history is one of the most important parts of your credit report, and it plays a significant role in determining your credit score. This section shows whether you’ve made your payments on time and if there have been any late payments. It includes:

- Late payments (how late and how often)

- Defaults or delinquencies

- Accounts in collections

- Bankruptcies (if applicable)

- Foreclosures (if applicable)

Any negative information in this section can have a major impact on your creditworthiness. If you’ve missed payments in the past, it’s essential to work on improving your payment habits moving forward to rebuild your credit.

- Credit Inquiries

Every time you apply for new credit, whether it’s a credit card, a loan, or a mortgage, the lender will conduct a “hard inquiry” (also called a “hard pull”) to check your credit report. This section of your credit report lists all the hard inquiries made in the past two years.

There are two types of inquiries:

- Hard inquiries: These occur when a lender checks your credit report as part of their decision-making process for granting you new credit.

- Soft inquiries: These occur when you check your own credit report or when companies review your credit for pre-approval offers. Soft inquiries don’t impact your credit score.

While hard inquiries can lower your credit score slightly, they are typically not a major concern unless you have multiple inquiries in a short period of time. Too many hard inquiries can signal that you’re applying for credit too frequently, which might raise concerns for lenders.

- Public Records

This section includes any public records related to your financial history, such as:

- Bankruptcy filings

- Foreclosures

- Tax liens

- Civil judgments (e.g., lawsuits that result in a financial judgment against you)

Public records can have a significant negative impact on your credit score. For example, a bankruptcy can stay on your report for up to 10 years, severely limiting your ability to access credit. If you’re in this situation, it might be worth exploring debt consolidation options to streamline your payments and help you recover financially.

How Your Credit Report Affects You

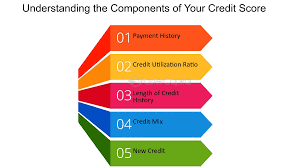

Your credit report is used to determine your credit score, which is a three-digit number that reflects your creditworthiness. The better your credit report, the higher your score, and the more likely you are to get approved for loans and credit cards at favorable terms. Here’s how a good credit report can help:

Loan Approval

When you apply for a loan, lenders will check your credit report to assess the risk of lending you money. A strong credit history with on-time payments and low credit utilization increases the chances of getting approved for loans and credit cards.

Interest Rates

The better your credit report, the lower your interest rates will be. A low-interest rate can save you thousands of dollars over the life of a loan, especially for big-ticket items like a mortgage or auto loan. On the other hand, a poor credit report can result in higher interest rates, making it more expensive to borrow money.

Renting and Employment

Landlords and employers may also check your credit report when making decisions. If you’re applying for a rental property, a poor credit report might make it harder to secure a lease. Similarly, some employers check credit reports as part of the hiring process, especially for positions that involve financial responsibilities.

How to Improve Your Credit Report

If you’ve reviewed your credit report and found areas that need improvement, don’t worry—there are steps you can take to boost your score:

- Pay Your Bills On Time: Timely payments are the single most important factor in improving your credit.

- Reduce Your Debt: Lowering your credit card balances or paying down loans can help improve your credit utilization ratio and raise your score.

- Dispute Errors: If you find mistakes in your credit report, you can dispute them with the credit bureaus to have them corrected.

- Avoid Opening New Credit: Applying for too much credit in a short period can negatively affect your score, so be strategic about new applications.

Final Thoughts: Keep Your Credit Report in Check

Your credit report is one of the most important financial documents you’ll have. It’s not just a record of what you owe; it’s a snapshot of your financial habits, and it can greatly influence your financial future. By understanding the structure of your credit report and keeping tabs on it regularly, you can make smarter financial decisions, boost your credit score, and avoid costly mistakes down the road.